Roth ira phase out calculator

Discover Fidelitys Range of IRA Investment Options Exceptional Service. Find a Dedicated Financial Advisor Now.

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

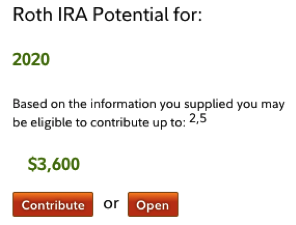

. For calculations or more. If your income falls in a phase-out range you are allowed only a prorated Roth IRA contribution. Tax Filing Status Income Phase-Out Range.

If your income exceeds the phase-out. This calculator assumes that you make your contribution at the beginning of each year. This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings.

Get Up To 600 When Funding A New IRA. Married filing jointly or head of household. Ad Do Your Investments Align with Your Goals.

Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. For 2022 the maximum annual IRA. Full contribution if MAGI is less than.

Ad Explore Your Choices For Your IRA. Married filing jointly or head of household. For comparison purposes Roth IRA.

Roth IRA 2022 Contribution Phaseout. Tax Filing Status Income Phase-Out Range. Lets say youre 35 years old and you work part-time making 7800 per year.

By Megan Russell on April 24 2020. If you are not covered by an employer-sponsored plan but your spouse is the deduction is phased out if the couples combined income is between 198000 and 208000. Roth IRA Phase Out Calculator.

It is mainly intended for use by US. So thinking youre not ready to retire following year you desire development as well as focused investments for your Roth IRA. 9 rows Multiply the maximum contribution limit before reduction by this adjustment and before reduction for any contributions to traditional IRAs by the result in 3.

Explore Choices For Your IRA Now. Ad Do Your Investments Align with Your Goals. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

Find a Dedicated Financial Advisor Now. Roth IRA 2022 Contribution Phaseout. You can contribute up to 20500 in 2022 with an additional.

Roth IRA contributions are limited for higher incomes. Roth IRA 2022 Contribution Phaseout. Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation.

Multiply the maximum contribution limit before reduction by this adjustment and before reduction for any contributions to traditional IRAs by the result in 3. To put it simply you wish to. Website builders The Roth IRA contribution phaseout range is currently a 10000 range.

An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. If you and your. For such people the Roth IRA phase out takes effect if you earn between 1 and 10000.

So to calculate your reduced Roth IRA. Married filing jointly or head of household. Wed suggest using that as your primary retirement account.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of one or more non-Roth IRAs ie traditional. Roth IRA contributions are limited for higher incomes.

If your income falls in a phase-out range you are allowed only a prorated Roth IRA contribution. Your spouse works full. Tax Filing Status Income Phase-Out Range.

Married filing jointly or head of household. If you have a 401k or other retirement plan at work. The calculator will estimate the monthly payout from your Roth IRA in retirement.

It will also estimate how much youll save in taxes since earnings on funds invested in a Roth IRA are tax. The amount you will contribute to your Roth IRA each year. No contribution if MAGI is over 140000 single or 208000 joint During the 2022 tax year your Roth IRA contribution is phased out based on MAGI.

More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Get Up To 600 When Funding A New IRA.

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Ira Calculator See What You Ll Have Saved Dqydj

Roth Ira Calculator Roth Ira Contribution

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Traditional Vs Roth Ira Calculator

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Phase Out Calculator 2019 Youtube

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

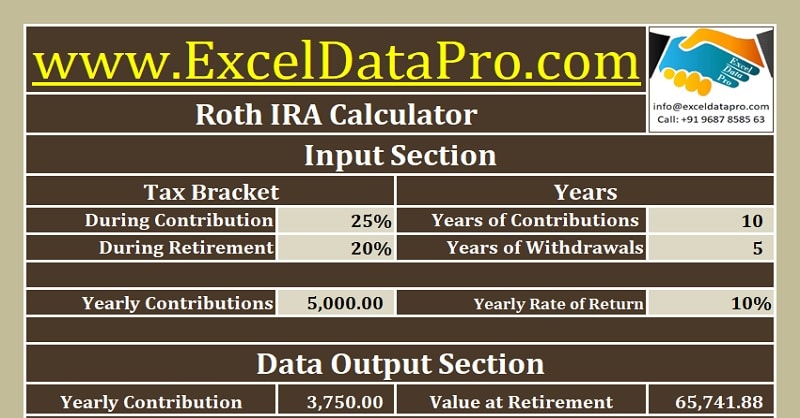

Download Roth Ira Calculator Excel Template Exceldatapro

Blog What Is The Best Roth Ira Calculator Montgomery Community Media

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Traditional Vs Roth Ira Calculator

Best Roth Ira Calculators

Roth Ira Calculator Calculate Tax Free Amount At Retirement

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution